Lack of funds should be the last obstacle for higher studies

Education Loan is defined as the loan designed to help students in their university tuition fees, books and living expenses at an interest rate. In current scenario we have many banks and institutions to back up and support our monetary requirement for higher education. For a better future we search hard the best institution and after securing an admission in an approved course our next step is of arranging fund. Arranging fund is quite tough these days with costly higher education, although these days many scholarships and other financial aids are available so that you can pursue your dreams without any monetary hindrances. With the help of education loan right support at the right time is given to deserving candidates.

Education loan in India

On 15th of August, 2015, Indian Government launched a website for education loan purpose www.vidyalakshmi.co.in for students that has been developed and maintain by NSDL e-Governance Infrastructure Limited under the Department of Financial Services in the Finance Ministry, Department of Higher Education, Ministry of Human Resource Development and Indian Banks Association (IBA) guidance. With the help of the website you can seek information, track and fill application of education loan. It is also linked to the National Scholarship portal.

Education loan for abroad studies

When you are dream of studying aboard, one of the biggest problem is of funding to get admission in your favorite college. Education loan is meant to cover your tuition fees, books and other expenses related to the course. Maximum education loan for domestic courses by bank is about 10 lakhs whereas for abroad studies minimum education loan amount is nearly 15 lakhs.

List of Education loan friendly banks and institutes in India:

SBI-Founded in 1921, Indian multinational financial service company - State Bank of India has 14,000 operational branches in India. SBI also has Scholar Loan Scheme offered to students who have secured admissions in premier Indian institutions.

HDFC-Housing Development Finance Corporation Limited is a private sector bank founded in 1994, that offers tailor made education loan to students who wants to take admission in India and abroad. With doorstep services for students, HDFC also give tax rebate education loan interests under Section 80-E of the Income Tax Act 1961. For abroad studies, HDFC has collaborated with Cedilla to offer customized educational loan for abroad studies that provides 100% finance and flexible repayment options.

Axis Bank-Axis Bank is the 3rd largest private sector bank in India founded in 1994 as UTI Bank. They have various education loan scheme for medicine, engineering and management related courses. Maximum loan limit for India is 10 lakhs whereas for abroad studies it is 20 lakhs. Interest rate for female applicant is lesser than the general category.

PNB-Punjab National Bank is the oldest and third largest public sector bank founded in 1894 in India catering over 80 million customers. PNB has various loan schemes to lessen the burden like CSIS (Central Scheme for Interest Subsidy), Concessional Education Loans to Persons with Disabilities (PwDs) and Padho Pardesh (Education loan scheme for overseas studies to students belonging to minorities).

Global Student Loan Corporation-The Global Student Loan is the only comprehensive education loan for international and distance learning students that does not require a co-signer from another country. They offer education loan only to non- U.S citizen around the globe.

Avanse-To empower the Indian youth who are in quest of their better future Avanse was established in association of DHFL (Dewan Housing Finance Limited). It is a new age education finance company that has funded over 2, 000 students in 36 different countries and over 100 universities around the world.

Documents required for education loan:

While applying for student loan you need to submit below listed documents with a student loan application form:

- Letter of admission from the institute.

- 2 passport size photographs.

- Parent income proof like salary slip, form 16.

- Cost break of the program like tuition-fees details and other expenses included during the course.

- Entire academic record of the student like 10th and 12th mark sheet and result of last qualifying examination.

- Affidavit of no pending loan from other bank or institution.

- Need address and ID proof like Passport, Driving license, Ration Card, Voter's ID card, Bank statement, Aadhaar card, Photo Pan Card, Passport.

- KYC (Know your customer) document.

- Bank signature verification.

- Birth certificate or 10th passing certificate for age proof.

Get Updated Review ( Voice Based Alumni Feeback)

Get Updated Review ( Voice Based Alumni Feeback)

-

Check Review (Alumni Feedback) - Lovely Professional University - [LPU] – Click Here

Check Review (Alumni Feedback) - Lovely Professional University - [LPU] – Click Here -

Check Review (Alumni Feedback) - Amity University – Click Here

Check Review (Alumni Feedback) - Amity University – Click Here -

Check Review (Alumni Feedback) - DIT University Dehradoon – Click Here

Check Review (Alumni Feedback) - DIT University Dehradoon – Click Here -

Check Review (Alumni Feedback) - Jagran Lake City – Click Here

Check Review (Alumni Feedback) - Jagran Lake City – Click Here -

Check Review (Alumni Feedback) - Ansal University – Click Here

Check Review (Alumni Feedback) - Ansal University – Click Here

For working professional you need to submit these documents as well:

- Details of present employment.

- Proof of income and Income Tax Returns for the last 3 years.

For abroad studies you need more documents in addition to the above like:

- Letter from the head of department of the university.

- Visa approval

- Copy of passport and cost of transportation fare.

- GMAT/GRE/SAT score

- Bank statement/passbook of last 6 months.

Expenses covered in education loan:

- Tuition fees

- Examination fees

- Books and computer

- Hostel or accommodation

- Educational trips

- Insurance

- Uniforms

- Passage money for abroad travel

- Two-wheeler expense (up to INR 50, 000)

Things need to check for applying for educational loan:

- Interest rate is fixed or floating.

- Will bank keep the certificates during the period of loan?

- Processing fees and prepayment penalty.

- Whether your course is vocational or skill development study as it doesn’t cover these courses.

Eligibility for education loan - Things considered in your education loan application by bank:

- Past academic record of the student.

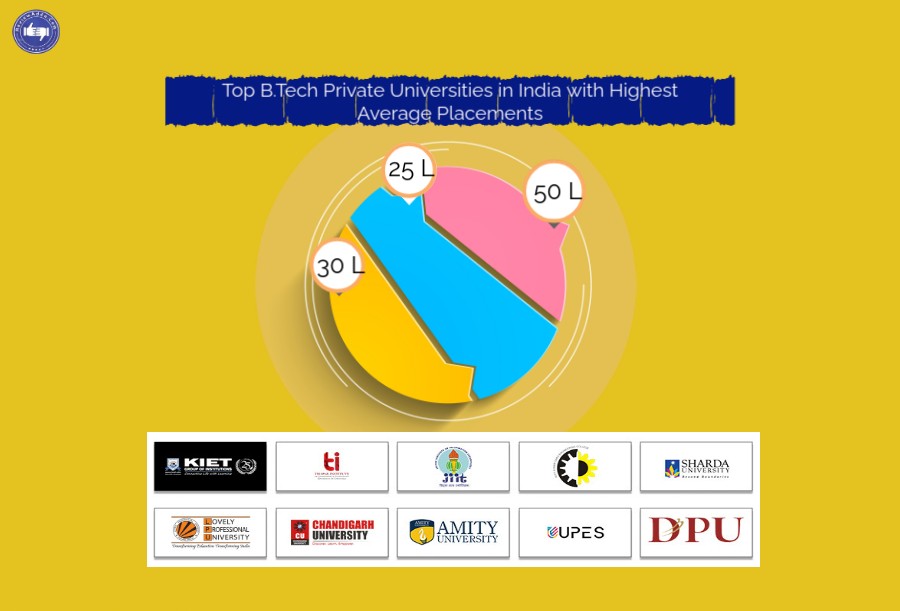

- Quality of the institution.

- Ability of the student of getting an appropriate job after the course.

- Loan eligibility is fixed according to the estimated potential salary.

- Credit history of the applicants.

- Value of property offered as collateral security for loan above 7.5 lakh.

- College/institution is approved by UGC/AICTE/IMC/Govt.

Procedure of education loan:

- Check for educational loans tie-up of educational intuition with any banks.

- Â If not, then approach for the bank in which your parents maintain an account.

- Loan is repayable from one year of the course completion or six months from gainful employment whichever is earlier.

- Loan repayment period is generally 5-7 years.

- For low income families, interest is borne by the Government of India until the repayment starts.

.jpg)