Top Recession-Proof Sectors

Introduction

Downturns, specifically recessions, are economic periods characterized by reduced GDP, increased joblessness, and decreased spending by consumers. These challenging times bring uncertainty, affecting some industries negatively while others remarkably hold firm. Navigating the intricacies of the economy requires an understanding of these dynamics.

Some sectors firmly grasp continuous need, even under harsh economic conditions. They provide vital goods or services that folks can't do without. That's why we call these sectors "recession-proof." Their demand remains constant despite general economic conditions. Often, stick-to-itiveness comes from what they offer —stuff people need daily.

Understanding the industries that stand tall during recessions is helpful. It helps people and businesses. With insights into industries that remain strong during tough times, people can make wise choices about jobs, money, or running a business. This information gives everyone more sureness for future negotiations. Now, let's look at those sectors that have stayed strong in past economic downturns.

Which industries have shown the most resilience during past recessions

The industries that have shown resilience during past recessions are:

1. Utilities:

Utility companies provide essential services like gas, water, and power. Demand will stay stable as long as consumers prioritize these needs and are protected by regulations.

2. Grocery Stores

During recessions, grocery businesses prosper as people redirect their expenditure from eating out to necessities like food purchases. This inelastic demand ensures steady sales.

3. Discount Retailers

Discount retailers perform well as consumers become more price-conscious. Stores offering low-cost goods attract increased foot traffic and sales during tough economic times.

4. Healthcare Services

The healthcare sector remains robust since individuals require medical care regardless of economic conditions. Demand for hospitals and pharmaceuticals stays consistent.

5. Education

Education services see increased enrollment during recessions as individuals seek retraining and skill enhancement to improve job prospects, supported by stable public funding.

6. Information Technology

The IT sector has become critical for efficiency during downturns. Companies invest in technology solutions to streamline operations, with SaaS models showing particular resilience.

7. Waste Management

Waste management services are stable as waste production continues regardless of economic conditions. Long-term contracts ensure steady revenue streams for these companies.

What are the Top Recession-Proof Sectors

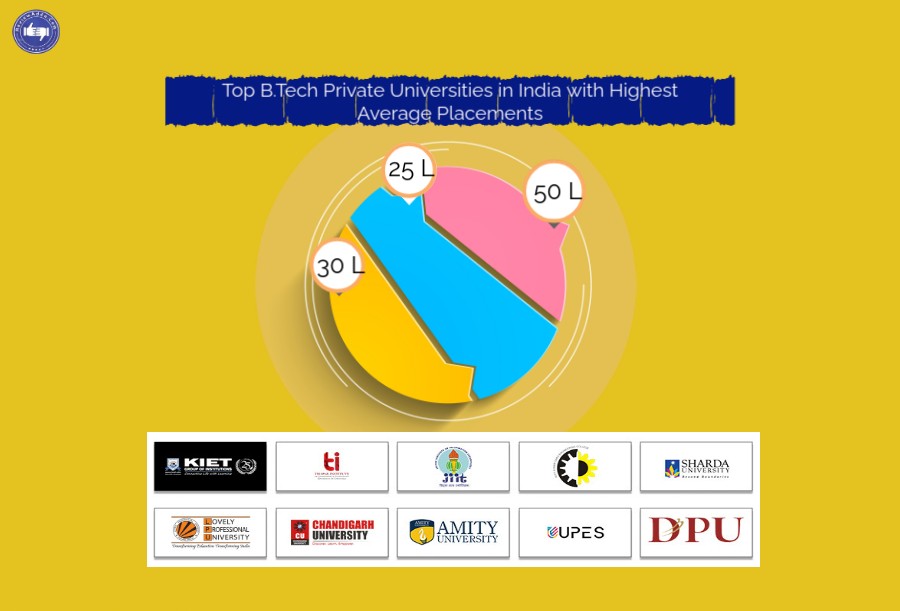

1. Education

-

The Reason Education Remains Stable: Education plays a vital role in society's development and is still necessary in bad times. Parents continually invest in their kids' schooling, while grownups commonly aim to advance their jobs through qualifications or extra study.

- Rise of Digital Education: When the economy falls, folks often look for adaptable, fair learning choices. Online certificates, classes, and skill-improvement sites like Coursera and Udemy get popular. Firms delivering learning tech (EdTech) grow. People want to widen their abilities to move with the changing job market.

- Vocational and Adult Learning: Workers needing new jobs hunt for retraining during economic slips. Hence, more people start enrolling in job training and grownup learning schemes.

2. Healthcare

-

Critical Nature of Healthcare: Healthcare is vital, regardless of the economy's state. People will always require medications, medical aid, and more. So, the healthcare sector will always be needed.

- Increased Need for Medical Services: Public health issues frequently become more pressing during difficult economic times. In hard times like a recession, the number of people facing mental health troubles may go up. Stress-related sickness might also increase. This makes preventing illnesses even more critical.

- Population Aging and Public Health: Healthcare business is steady and reliable. Why? Well, all over the world, folks are getting older. This means they need healthcare services. With age comes chronic diseases and the need for elder care. These are things the healthcare industry provides. So, there's a constant need for these services.

3. Food Services

-

The Essential Nature of Food: Food is essential because people must eat regardless of their financial status. This means that the demand for food will always exist in the sectors that produce, distribute, and provide services.

- Change in Consumer Behavior: Although fancy restaurants may suffer, fast-food companies and supermarkets that offer reasonably priced meal options frequently see an increase. Customers may ditch dining out. They might start whipping up meals at home, doing grocery shopping, or choosing inexpensive food choices such as fast food.

- Resilience of Affordable Food Services: Fast food chains and budget-friendly eateries tend to thrive in tough economic times. Why? They offers speedy, affordable meals that draw in folks watching their wallets.

4. Discount Retail Stores

-

The success of cheap Retailers: When people's budgets are smaller, they shop at cheap retail businesses with reduced prices. Sales at stores like Walmart, Dollar General, and Aldi frequently rise as consumers choose value over name.

- Shifting Consumer Preferences: During recessions, people become more cost-sensitive and look for deals on necessities like food, home products, and apparel. This creates a long-term need for discount stores.

- Discount retail chains' performance: Large-scale discount stores have performed better than other retail sectors throughout previous recessions because they can provide essential products at cheaper costs, which appeals to customers on a tight budget.

5. Utilities

-

Essential Character of Utilities: Gas, water, and electricity are necessities whose demand never fluctuates, notwithstanding the state of the economy. Utility services are still necessary for daily living, which makes this industry incredibly recession-proof.

- Minimal Economic Impact on Utility Services: Despite a drop in discretionary expenditures, businesses and consumers alike must continue to pay for these basic services; therefore, utility providers face reasonably consistent demand.

- Utilities and Long-Term Investment: Because the utility industry has a steady and regular cash flow, investors frequently view it as a "safe haven" during downturns. This makes it a dependable sector to invest in during recessions.

6. Government Jobs

-

Stability of Government Employment: The fluctuations in the private sector's layoffs have less of an impact on government employment. Longer-term budgeting and necessary operations that carry on regardless of the state of the economy frequently safeguard jobs in the public sector.

- Consistent Demand for Public Services: Due to their importance to society's operation, public services, including infrastructure upkeep, public health, education, and law enforcement, typically see lower layoffs during recessions.

- Government-Supported Job Initiatives: Governments frequently implement stimulus programs or public works initiatives during recessions to stabilize employment and create opportunities in industries like infrastructure, healthcare, and education.

7. Social Media

-

Increasing Social Media Usage During Recessions: During uncertain economic times, people use social media more for connections, entertainment, and news. Facebook, Instagram, and Twitter are becoming increasingly relevant due to the rise in screen time and dependence on digital communication.

- Digital Advertising in a Downturn: Businesses move their marketing tactics toward more cost-effective digital advertising to preserve brand visibility. Social media sites, thanks to the numerous users, turn into a key way for cost-effective promotions. This makes them withstand economic downturns well.

- Content Creation and Monetization: As conventional jobs disappear, many individuals seek extra income via social media. They turn to influencer advertising, partnerships with brands, or crafting posts and videos.

8. Logistics

-

Growth in E-commerce and Delivery: With online shopping booming, logistics is seeing a rising demand for handling goods, storing them, and getting them delivered. This is especially true during recessions when more people purchase online.

- The Crucial Role of Supply Chains: Even during an economic downturn, companies must still distribute goods, and customers depend on prompt delivery and transportation. Thus, shipping and transportation are always in demand in the logistics industry.

- Globalized Trade and Transportation: Even in economic slumps, logistics and transportation companies keep working. Why? Goods still have to move across lands and seas. This is due to global commerce being linked together.

9. Transportation

-

Necessity of Public Transportation: People need public transportation. Whether is for a job commute or daily tasks, and it's essential no matter for the economy's health. During recessions, sustained use of public transit systems is standard.

- Shifts Toward Cost-Effective Transportation: During downturns, consumers may lower their transportation costs, choosing cheaper alternatives like public transit, carpooling, or ride-sharing services (e.g., Uber, Lyft), leading to increased reliance on economical transportation options.

- Logistics & Freight Transportation: This industry is a dependable source of income throughout recessions since freight transportation is still an essential component of supply chain activities, guaranteeing that items reach retailers and customers.

10. Baby Products

-

Steady Demand for Baby Necessities: Despite economic downturns, parents prioritize buying necessities for their infants, such as clothing, formula, diapers, and baby food, ensuring that this sector remains recession-resistant.

- Budget Alternatives for Baby Goods: During recessions, families may hunt for cheaper brands or buy in bulk, but they will continue buying necessities for their children, keeping the baby product sector afloat.

- Ongoing Demand for Childcare-Related Services: Even as parents reduce other expenses, the need for childcare products and services endures, supporting the sector's overall stability during economic downturns.

11. Freelancing

-

Rise in the Gig Economy: When the economy takes a dip, companies usually let go of some full-time employees. This makes room for freelancers to step in, offering flexible, job-based help. Freelancer, Upwork, and Fiverr find success in such times.

- Freelancing as an Income Alternative: Faced with downturns, a lot of pros pick freelancing to keep the cash flowing. Writing, graphic design, coding, or marketing skills can be put to use for brief contracts.

- Flexibility and Low Overhead Costs: Freelancers give their services without the heavy costs of regular companies. That means they can ride out economic ups and downs more easily.

12. Technology Support

-

Growing Dependence on Technology: Even as technology becomes a core part of our lives, used for staying connected, running businesses, or simply having fun, there's always a need for dependable IT help and tech fixes. This need stays steady, even when the economy dips.

- Digital Transformation of Businesses: Businesses often turn digital in tough economic times to cut costs. This increase in tech usage ramps up the demand for help in fields like cloud computing, cybersecurity, and systems for working remotely.

- Remote Work and IT Services: When people start working from home more, like in tough financial times, there's a bigger need for tech help. This makes IT experts wanted a lot as companies aim to smooth out their processes using tech answers.

What are the critical characteristics of recession-proof industries?

Some industries weather economic storms better than others, growing or staying stable even when others are on shaky grounds. Understanding the unique qualities of these sectors can help job seekers, and investors find opportunities less exposed to economic fluctuations.

1. Essential Goods and Services

Recession-proof sectors of the economy usually offer necessities that customers find difficult to cut from their spending plans. This includes:

-

Healthcare: Every individual, no matter their wallet's weight, requires medical help and medicine.

-

Utilities: Life demands services such as gas, water, and electricity. Most notably when, finances are tricky.

2. Inelastic Demand

Industries that can withstand a recession often offer goods and services with a non-flexible demand. This suggests that consumers continue to purchase, regardless of price increases or income drops. For example:

-

Consumer staples: No matter the economy's condition, essentials such as food, hygiene products, and cleaning supplies are always needed.

- Repair Services: Tight finances or not, crucial fixes like home or car repairs must happen.

3. Stable Revenue Streams

During recessions, businesses that are resilient to them usually have steady sources of income. This stability can be attributed to:

-

Long-term Contracts: For secure and stable income, many utility companies operate with lengthy deals or regulated cost structures.

- Recurring Revenue Models: Companies in software and telecom fields, for instance, provide services on a subscription basis, ensuring a regular money stream.

4. Government Support

Industries that receive substantial government funding or regulation often demonstrate resilience during recessions. Examples include:

-

Public Services: Sectors such as education and public safety typically receive government support, ensuring continued operation even during budget cuts.

- Defense: Government contracts for defense-related services often remain stable regardless of economic conditions.

5. Adaptability

Recession-proof industries frequently adapt to changing consumer needs and economic conditions. For instance:

-

Technology Services: In times when firms are penny-pinching, tech options gain ground. They helps businesses in this field flourish.

- Education: In lean seasons, people tend to chase extra skills or knowledge, which spikes the need for teaching services.

6. Low Price Sensitivity

Industries that offer products with low price elasticity tend to perform better during recessions. Consumers prioritize essential items over luxury goods, leading to:

-

Discount retailers: When times are tight, folks lean toward cheaper choices. This boosts the profits of these stores.

- Baby Products: Despite money woes, parents keep purchasing the essentials for their kids.

7. Strong Financial Health

Companies in safe-from-downturn sectors often show solid financial standing with manageable debts. Their economic robustness allows them to endure financial slumps better than some, thanks to this fiscal stability. Key indicators include:

-

Profit Margins: Businesses having more profit get better protection against sudden disruptions.

- Cash Reserves: In turbulent economic times, companies having a good amount of saved funds can keep working without heavily relying on borrowed money.

8. Historical Performance

Analyzing historical performance helps identify industries that have consistently weathered past recessions. For example:

- People investing money often choose consumer basics and healthcare. Why? They're reliable. In tough times, these areas have proven robust.

Challenges Faced by Recession-Proof Industries

Even though some sectors are deemed safe from recessions because they keep steady during economic slumps, they still confront particular difficulties and weaknesses. Grasping these difficulties is essential for evaluating their endurance over time.

Potential Vulnerabilities Despite Resilience

-

Dependence on Consumer Behavior: Even sectors seen as recession-proof can face changes due to consumer actions. For example, even as healthcare and supermarkets usually keep their demand, consumers might opt for cheaper choices or postpone non-critical purchases, leading to revenue shifts.

- Market Saturation: As more firms notice the stability of specific sectors, rising rivalry can cause an overcrowded market. This situation could push prices down and shrink profit margins, posing challenges for firms trying to maintain their financial wellbeing.

- Regulatory Changes: Some sectors, like healthcare, face heavy regulations. When these government policies or rules change, it can cause doubt and drive up operational costs, possibly hurting profits even in sectors that are usually stable.

- Supply Chain Disruptions: Industries thought to be recession-proof are not safe from worldwide supply chain problems. For instance, interferences due to geopolitical issues or natural disasters can influence the supply of vital goods and thus raise costs and decrease sales.

- Labor Shortages: Many sectors viewed as recession-resistant depend on a steady workforce. Economic downturns can lead to job cuts in other sectors, leading to a labor deficit in essential areas like healthcare and manufacturing, potentially putting pressure on operations and elevating costs.

Economic Factors That Can Impact Stability

-

Reduced Consumer Spending: When the economy dips, folks cut back on spending. Necessities usually keep selling, but people might stop buying extras. This can even shake up supposedly recession-proof markets.

- Tighter Credit Conditions: Loan access usually tanks during financial slumps. Businesses that need loans for their day-to-day or growth twist in the wind. Even sturdy sectors like construction and manufacturing reel.

- Inflationary Pressures: Upward creeping prices for introductory materials and workforce can strain profit, leaving diverse industries flailing. Even recession-proof industries find it hard to stay profitable if they can't shake off these costs to customers without losing business.

- Global Economic Conditions: Industries that are recession-proof aren't exempt from the world economy. Elements like trade freeze-ups or wavering currencies can destabilize supply and demand, rocking even steadfast sectors.

- Technological Disruption: Quick-fire tech progress can topple traditional business setups even in supposedly safe sectors. Firms that can't keep pace can lose their competitive edge, impacting their future stability.

What are the key financial metrics to evaluate recession-proof companies

Here's a table summarizing the key financial metrics to evaluate recession-proof companies:

These metrics can help investors identify companies that are more likely to withstand economic downturns and maintain stability in their operations.

How do recession-proof companies maintain profitability during downturns?

Organizations that can weather a recession stay profitable even in tough economies by using various intelligent strategies:

1. Diversification

Recession-proof companies often diversify their product lines and markets. By not relying on a single revenue stream, they can lessen risks connected with economic changes. This strategy allows them to adapt to changing consumer demands and market conditions, ensuring steady income even when specific sectors struggle.

2. Cost Efficiency and Automation

Investing in cost-cutting technologies and automation helps these organizations sustain productivity with fewer resources. For instance, adopting cloud services can reduce infrastructure costs while automating routine tasks decreases labor expenses. This emphasis on efficiency enables businesses to continue operating during recessions without compromising product quality.

3. Understanding Consumer Behavior

Firms that can weather economic downturns keep a watchful eye on changes in what customers value. They tweak their products and services to match these changes. When consumers need to tighten their purse strings, these companies adjust. They meet an expanding need for worth and affordable pricing.

4. Strong Customer Relationships

Developing and preserving strong client relationships promotes loyalty, which is essential in challenging economic times. Even in times of constrained budgets, businesses that make an effort to comprehend their client's demands and deliver exceptional service have a higher chance of keeping consumers.

5. Robust Online Presence

A strong internet presence enables recession-proof enterprises to reach a more extensive client base. By improving their e-commerce capabilities and providing digital services, these companies can maintain revenue generation even in the face of challenges faced by their physical locations.

6. Cash Reserves

Businesses must have a significant amount of cash set aside to endure times when revenue decreases. These funds help companies manage their daily expenses and pay their employees and obligations during challenging periods, ensuring they remain financially stable.

7. Adaptability

Recession-resistant companies are adaptable and quick to adjust to market shifts. They stay relevant in a changing economy by consistently analyzing industry trends and consumer preferences, allowing them to modify their business plans accordingly.

8. Investment in Workforce

Maintaining and supporting skilled employees boosts efficiency and team spirit. When workers are involved, they're better at tackling financial hurdles; this increases a company's resilience during tough times.

Are there any emerging sectors that could become recession-proof in the future

Industries on the rise that have the potential to withstand economic downturns in the future are changing consumer trends, technological progress, and societal demands. Here are a few critical sectors that are well-positioned to remain strong in times of financial hardship:

1. Healthcare Technology

Virtual health and digital wellness are on the rise. This growth is a boon for businesses focusing on remote health solutions. People always need accessible, budget-friendly healthcare, no matter the economy. They care about their well-being. Tech upgrades in health can boost care quality and speed. Thus, it makes services attractive for customers, setting them up for future success.

2. E-Learning and Educational Technology

Online learning platforms sprouted up, totally transforming education. Now, it's much more easy to access and flexible. In times of economic instability, people frequently aim to enhance their abilities or undergo training for different professions, creating a need for online learning options. Even in tough economic times, companies offering affordable and effective online education should keep folks intrigued.

3. Sustainable and Renewable Energy

The planet is turning towards a greener focus, so renewable energy promises significant expansion. As people get more thoughtful about green issues, they will want eco options like sun and wind power. This swap not only eases climate change effects, but it means jobs and perks for local folks.

4. Logistics and Supply Chain Management

In these tough times, like the COVID-19 crisis, the logistics sector's role shines brightly. With the rise of e-commerce, firms involved in delivery, warehousing, and managing supply chains are crucial. Their flexibility to adapt to changing consumer demands strengthens their ability to weather financial storms.

5. Cybersecurity

Technology's growing importance leads to a rise in the need for cybersecurity. As cybercrime threats mount, companies need to defend their important data with top-notch cybersecurity systems. Providers of such vital security help keep crucial information safe.

6. Home Services and Maintenance

In shaky economic periods, folks focus on maintaining their homes. Areas like home fix-up, scrubbing services, and property upkeep tend to thrive. These services, always needed, become a steady business source, even when the economy's on the ropes.

7. Pet Care Services

Even in tough economic times, the pet care industry often remains strong. Pet owners regularly set aside money to take care of their pets' needs. Basic services such as pet grooming, vet care, and home pet care stay in demand. Why? People and their pets share deep bonds that drive these choices.

8. Digital Marketing

As more companies shift online, digital marketing is becoming crucial to reach customers effectively. Those businesses mastering SEO, social media campaigns, and compelling content are projected to succeed. They're looking for cost-effective ways to keep their brand in sight and connect with people, especially during harsh economic conditions.

Conclusion

-

Resilience of Essential Industries: Key Businesses: Key types of work have stepped up. Be it their valuable services or adaptable business tactics.

- Strategic Career and Investment Moves: Seeing which businesses stand strong during downturns helps people and firms decide where to put their resources during difficult times.

- Final Thoughts: No kinds of work are totally safe from economic drops, but some have shown great strength and growth, making them safer choices in uncertain economic times.

.jpg)