Topic We Cover: Company Secretary (CS) Vs. Chartered Accountant (CA)

- What is the difference between CA vs CS?

- What is CA?

- What is CS?

- Snapshot of details of both the Courses

- Why pursue CA vs CS

- Why Pursue CA?

- Why Pursue CS?

- Differences in Career Path of CA and CS

- How to become a Company Secretary (CS)

- How to become a Chartered Accountant (CA)

- Differences in Duration of course of CA and CS

- Differences in Subjects of CA and CS

- CS vs CA: Why not have Both?

- Career Scope of CA vs CS

- Chartered Accountant

- Company Secretary

- Opportunities for CA and CS

- Chartered Accountants

- Company Secretaries

- Salaries of CA and CS in India

- Chartered Accountant Salaries by Experience Level

- CA Salary in India based on Skills

- CA Salary by Location

- Company Secretary Salary In India

- Differences in Nature of Work of CA and CS

- Differences in Workplaces of CA and CS

- Conclusion

Company Secretary (CS) Vs. Chartered Accountant (CA)

Everybody have some career goals in their mind. There is a time in everybody’s life when then need to decide on what streams we would opt for further studies is paramount. Be it any stream of studies, to great success passion linked with hard work and persistence is the only ingredient.

Likewise, Commerce Stream brings with itself a plethora of opportunities for students. A young graduates of commerce would find ample opportunities in different fields of work from marketing to finance.

In this write-up, we try to highlight two most popular career paths for commerce students i.e Company Secretary (CS) and Chartered Accountant (CA). We hope by the time you complete reading this you will have a clear picture of the pros and cons of the two professions and accordingly chose the right one as per your interests.

There is no requirement to introduce such a special and respectable two positions in the world, Chartered Accountant (CA) and Company Secretary (CS). These two choices are the first preference for many commerce students. Every year, thousands of fresh students join the club of aspirants who combine day and night to crack the required examinations. This is because of a plethora of opportunities available for the professionals after pursuing the course.

When every year thousands of students are all set to opt between Chartered Accountant and Company Secretary, a question hits the mind: What is the difference between the two. To understand it better, let's learn about both the professions in detail.

What is the difference between CA vs CS?

What is a CA?

Chartered Accountants are known as the experts in Accounting. Chartered Accountants are referred to one of the most intelligent groups of people. They are a complete package of talent and hard work as well. The word Chartered itself shows a respect towards the person pursuing this course or become a CA.

They are considered a highly knowledgeable person as they persist a wide knowledge of Taxation, Accounting, Corporate Laws, Auditing, etc. Being the smartest person, Career Options for the CA is infinite. An international accounting credential of Chartered Accountant (CA) is that to acquire by following a course of study and clearing an exam conducted by a Chartered Accountant Inst. in the country of certification.

But becoming a CA is not easy. This has been referred to the Toughest Course in India conducted by ICAI (Institute of Chartered Accountants of India). So, if you wish to pursue CA, the first thing you must possess is patience. In this course the students have seen often giving a number of attempts but once when they become CA, there is no limit to success. The moment prefix “CA” is added with their name, then in many domains they will be called an expert.

Students good at calculation should go with CA as it consists of mostly practical subjects. CAs are accounting experts and perform detailed accounting functions within an organization or governmental entity.

What is a CS?

Company Secretary is a profession based on Corporate Governance of a Company. The CS has been chosen as an advisor or MD of the company in relation to the company affairs being a highly knowledgeable person in respect of Company Law. A Company Secretary (CS) possess an administrative position within a company. It is not a position of managerial support, which is usually associated with the term “secretary.” In fact, some CSs are attorneys or have MBAs.

CS is responsible to handle the legal affairs of the company. S/he ensures that the company and its Board of Directors both are operating within the Provisions of Company Law.

Well, passing and finishing CS is also not easy, not as complicated as CA, but not easy as B.com. Similar to CA. here also students have seen giving multiple attempts so students who wish to pursue CS must have patience too. They are recognized as an expert of Company and Allied Laws.

If you are good at theory you should go with CS. The country in which the CS is hired will decide the scope of responsibility. In some countries, employment of a CS within an organization is compulsory. In general terms, a CS guarantees that the company and the directors perfors within the law.

They also may perform primarily in recordkeeping, some accounting functions. The necessity for becoming a CS changes greatly and largely depend on the country in which you work. For Company Secretaries examples of organizations that offer specific training include the Institute of Company Secretaries of India (ICSI) and the ICSA in the U.K.

Snapshot of details of both the Courses

|

Particulars |

Chartered Accountant |

Company Secretary |

|

Duration |

4 Years |

4 Years |

|

Levels of course |

1. CA Foundation |

1. CS Foundation |

|

2. CA Intermediate |

2. CS Executive |

|

|

3. CA Final |

3. CS Professional |

|

|

Eligibility |

10+2 |

10+2 |

|

Fees |

1. CA Foundation = Rs. 9,000 |

1. CS Foundation = Rs. 4,500 |

|

2. CA Intermediate = Rs. 15,000 |

2. CS Executive = Rs. 8,500 |

|

|

3. CA Final = Rs. 22,000 |

3. CS Professional = Rs. 12,000 |

|

|

Core Areas of Study |

Taxation, Accounting, Financial Mgmt, Audit, Costing, Company Law |

Economic and Labour Laws, Corporate Laws, Business Incorporation, Capital Market, Secretarial Audit and Due diligence, Drafting etc |

|

Training |

after passing of first group of 12th exam there will be a training of 3 Year |

1 year = For Professional cleared candidate 2 year = For Executive cleared candidate |

|

Exam |

in May & November (Twice a year) |

in June & December (Twice a year) |

|

Exam fees |

1. CA Foundation = Rs. 1,000 |

1. CS Foundation = Rs. 1,200 |

|

2. CA Intermediate = Rs. 2,700 |

2. CS Executive = Rs. 2,400 |

|

|

3. CA Final = Rs. 3,300 |

3. CS Professional = Rs. 3,600 |

|

|

(Last Exam) Passing % |

CA CPT (Foundation) = 40% |

CS Foundation = 65% |

|

CA Intermediate = 20% |

CS Executive = 9% |

|

|

CA Final = 18% |

CS Professional = 14% |

Why pursue CA vs CS

Why Pursue CA?

There are a few reasons for which you should pursue CA –

- Once you successfully completes CA you will be called an expert of many domains. It is a course of professionalism that can give you instant credibility.

- CA is a course that needs a lot of pursuance and while pursuing this course you will learn a lot about hard work, resilience, and intelligence. These are the life skills you need to make your impression in any professional career.

- CA has a great reputation and authority. Even if you don’t want to join a company, you can do your own practice. It’s one of the self-employed professions that are revered in the society like doctors and engineers.

Why Pursue CS?

CS has a defined scope but it’s much progressive from a global perspective. Let’s see why you should pursue a CS.

- Once you finish your CS, you will be considered as an authority of company communication and laws. Both will be tremendous tools to run a company.

- As a CS, your biggest benefit is you can directly offer recommendation to the board of directors and they will act as you say in legal matters. Imagine the responsibility you have as a CS.

- Even if CA is given more eminence, CS is equally tougher and only a few people can clear it that makes you one of the best in a whole of students and professionals.

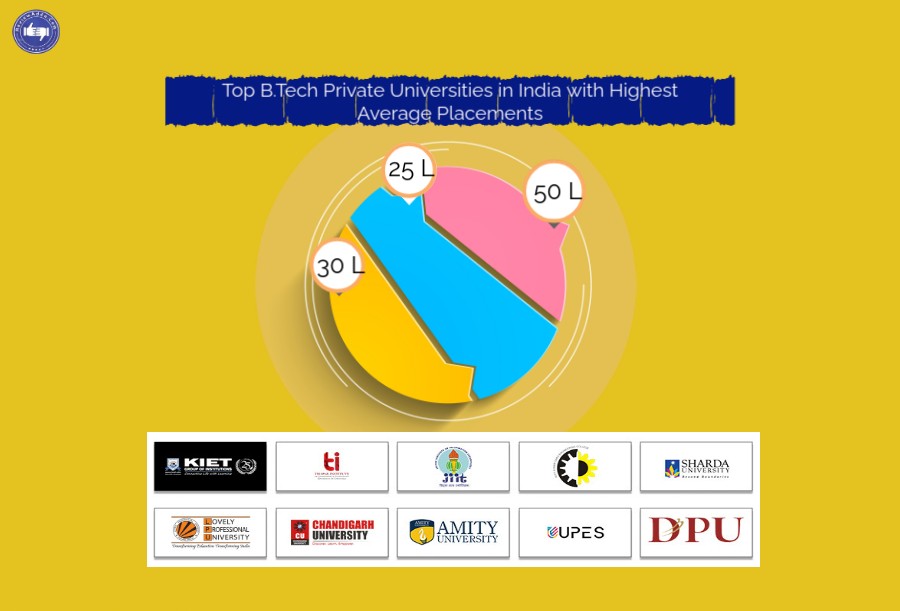

Get Updated Review ( Voice Based Alumni Feeback)

Get Updated Review ( Voice Based Alumni Feeback)

-

Check Review (Alumni Feedback) - Lovely Professional University - [LPU] – Click Here

Check Review (Alumni Feedback) - Lovely Professional University - [LPU] – Click Here -

Check Review (Alumni Feedback) - Amity University – Click Here

Check Review (Alumni Feedback) - Amity University – Click Here -

Check Review (Alumni Feedback) - University of Petroleum and Energy Studies [UPES] – Click Here

Check Review (Alumni Feedback) - University of Petroleum and Energy Studies [UPES] – Click Here -

Check Review (Alumni Feedback) - MMU Mullana – Click Here

Check Review (Alumni Feedback) - MMU Mullana – Click Here -

Check Review (Alumni Feedback) - Ansal University – Click Here

Check Review (Alumni Feedback) - Ansal University – Click Here

Differences in Career Path of CA and CS

Either in the public or private sector, Chartered Accountants provides accounting services to clients. Their expertise and areas of study include taxation, auditing, business/managerial accounting, and financial reporting.

Between the company and its shareholders, the CS acts as a primary source of communication, such as taking and distributing minute from shareholder meetings. In some countries, the CS will perform some accounting functions such as storing and managing the Company’s Accounting Records, (e.g. property, reinvestments, payroll, taxation, insurance, etc.) In some circumstances, CAs may also function as Company Secretaries.

How to become a Company Secretary (CS)

To pursue a career as a Company Secretary, follow these steps:

- Register with the Institute of Company Secretaries of India (ICSI).

- Pursue the foundation course for 8 months.

- Pursue the executive program for 1 year.

- Pursue the professional program for 1 year.

Alternatively, you can also go for the Company Secretary Course after completing your graduation. The route is as follows:

- Pursue graduation in a commerce field for 3 years

- Pursue the executive program for 1 year.

- Pursue the professional program for 1 year.

How to become a Chartered Accountant (CA)

To become a CA in India, you need to go through the following steps:

- Register with the Institute of Chartered Accountants of India (ICAI).

- Clear the Competency Professional Test (CPT) and pursue Bachelor of Commerce (full time).

- Clear the Integrated Professional Competence (IPC) Examination.

- Pursue Article ship for 3 years.

- Clear the CA Final exam.

You can take the CPT Exam right after class 12th to enroll into the course. However, you require to be a graduate to give the IPC exam. Rather, you can also finish your graduation and directly enroll for the IPC exam.

Differences in Duration of course of CA and CS

There are 3 levels in both CS and CA, but the duration for the steps differs. On an average, CS is a shorter course, and takes about 2-3 years, while CA takes about 5 years to complete.

Differences in Subjects of CA and CS

The subjects you will study as part of a Chartered Accountancy Course will focus on domains such as Accounting, Banking, Finance, Taxation, etc.

Some subjects include:

- Fundamentals of Accounting

- Cost Accounting and Financial Management

- Auditing and Assurance

- Management Accounting and Financial Analysis

- Direct Taxes

In a Company Secretary Course, you will study subjects that will help you become an expert at company law. Some subjects include:

- Basic Economics and Business Environment

- General and Commercial Laws

- Tax Laws

- Company Law

- Economic Labour and Industrial Laws

- Banking and Insurance – Law and Practice

CS vs CA: Why not have Both?

You can. Yes, you read it right, but in Sri Lanka, for example, a Chartered Accountant can hold the position of Company Secretary. If you are a CA and wish to also become a CS, you can look after with the country in which you are hired to see what the additional necessity is.

If you are a CS and want to believe more duties related to financial accounts within your organization or change careers entirely, then you will obviously require more formal training to earn CA designation.

In most cases, there isn’t a point to get both of these certifications. Both courses offer different opportunities, but mostly in cases a CA can do everything that a CS can do. Thus, if you are wishing to get one certification, you are better off just becoming a Chartered Accountant.

Career Scope of CA vs CS

Chartered Accountant

- It is a Professional Course that accumulates enormous credibility. Even if you don’t like to join a company, you can go for your own practice. And develop clients on merit.

- A large number of existing Private Chartered Accountant firms can easily employ CA.

- From their expertise, Capital Markets benefit a lot and hence demands are always high.

- A skillful Chartered Accountant can work for Public Sector, Government Service, or even in the Private Sector.

- It is a myth that a CA’s work involves only numbers and excel sheets. A CA hired by a firm can also contribute towards enhancement of profits and decision making for the firm.

- Make in India and 100% FDI schemes have further accelerated demand for CA’s in the manufacturing and financial services sectors.

- CA over the years has developed into a good career alternative for women as it acknowledges work to be done at one’s own speed and time.

- Unlike other employed professional’s, CA is free to take a break in his / her profession.

- CA Certification is globally recognized which is given by the Institute of CA of India. One can even practice in Australia, England, etc.

Company Secretary

Not only in India but across the globe as well, the Institute of Company Secretaries of India (ICSI) is expanding the reach of CS professionals. The exam is conducted by the inst. and over the years pass out of CS from the institute have enjoyed great respect and opportunities. Corporate sector and progress in the corporate sector lead to involvement of legal complications and legalities.

- On company laws and communication, CS Professionals are considered as an authority. Both factors administer the smooth functioning of any corporate-level organization.

- CS can directly recommend the board of directors and in legal matters, they will act as you say. But always keep in mind with great power comes great responsibility.

- CS professional expertise in Law are highly sought after by Stock Exchanges, Government-backed Financial Inst., Nationalised Banks, Dept. of Company Affairs etc.

Opportunities for CA and CS

Chartered Accountants:

Due to the complicated taxation system of the country, for smooth compliance CAs are in more demand for taxation laws of the country. From small person and business to Multinational Companies, everyone requires the services of CAs like GST returns, filing of income tax returns, financial management, accounting and bookkeeping, costing, etc.

Areas where Chartered Accountant can start practice

- Income Tax, Accounting, and Audit

- Indirect tax i.e GST

- Shares, Valuation of Business, Intellectual Property

- Management and Financial Planning

- Costing

Company Secretaries:

Whereas, a company having paid-up share capital of ? 5 crores or more shall be needed to have a whole-time company secretary under the Companies Act, 2013.

A company secretary, as similar to Chartered Accountant, can initiate his/her own practice. A Company Secretary in practice may start consultancy services for banks, companies, and financial institutions, etc.

Areas where Company Secretaries can begin practice

- Business Registration

- Corporate Laws Consultancy

- Due diligence and Secretarial Audit

- Bankruptcy Laws and Insolvency

- Securities Law

- Corporate Restructuring like Amalgamation, Merger, Winding up, etc

This is just an indicative area where CA and CS can begin their practice. There are other end numbers of areas where a CA/CS can excel and increase their career.

Salaries of CA and CS in India

As already specified earlier Chartered Accountants are entitled to significantly acceptable payment. With varying degrees of contribution in both private sectors and public sector undertakings, In India Chartered Accountants are entitled to some of the best salaries any business has to offer.

Chartered Accountant Salaries by Experience Level

The already attractive pay packages that Chartered Accountants are entitled to will grow periodically with the increasing number of years in the field.

|

Experience |

Annual Average Salary |

|

Fresher or less than a year |

INR 2.4 lakh to INR 11 lakh |

|

1-4 years |

INR 3 lakh to INR 11 lakh |

|

5-9 yrs |

INR 3.5 lakh to INR 20 lakh |

|

10-19 years |

INR 5 lakh to INR 25 lakh |

|

20 years and more |

INR 5 lakh to INR 30 lakh |

CA Salary in India based on Skills

In prime industries as Chartered Accountants have bright prospects such as Banking, Finance, Tax, etc, they can look forward to different pay packages offered in each of these industries:

|

Skills |

Annual Average Salary |

|

Accounting |

INR 6.3 lakh |

|

Auditing |

INR 6.9 lakh |

|

Internal Audit |

INR 6.1 lakh |

|

Financial Reporting |

INR 6.7 lakh |

|

SAP FICO |

INR 6.6 lakh |

|

Tax Consulting |

INR 6.6 lakh |

CA Salary by Location

On basis of differences in costs of living in prime cities variations in salary ranges also exist:

|

City |

Annual Average Salary |

|

New Delhi |

INR 2.4 lakh to INR 10 lakh |

|

Hyderabad, Andhra Pradesh |

INR 3 lakh to INR 20 lakh |

|

Mumbai, Maharashtra |

INR 3.7 lakh to INR 20 lakh |

|

Chennai, Tamil Nadu |

INR 3.4 lakh to INR 20 lakh |

|

Bengaluru, Karnataka |

INR 2.4 lakh to INR 20 lakh |

Company Secretary Salary In India

Average Salary Of Company Secretary In India Per Month!!! Those who are looking for Maximum Salary Of Company Secretary they can check from below framed table:

|

Particulars |

Company Secretary Salary Package |

|

Salary |

Rs 247,142 – Rs 1,374,138 |

|

Bonus |

Rs 10,022 – Rs 390,555 |

|

Profit Sharing |

Rs 12,671 – Rs 690,428 |

|

Total Pay |

Rs 248,933 – Rs 1,442,945 |

Company Secretary Remuneration Based on Experience

|

Experience |

Annual Average Salaries |

|

Less than a year |

INR 119,195 – INR 805,366 |

|

1-4 years |

INR 232,260 – Rs 770,450 |

|

5-9 years |

INR 302,012 – Rs 1,468,135 |

|

10-19 years |

INR 380,000 – INR 2,440,000 |

|

20 years or more |

INR 1,768,743 – INRÂ 1,924,279 |

Company Secretary India Salary Based on Cities

|

Cities |

Annual Average Salaries |

|

Mumbai, Maharashtra |

INR 982,635 – INR 1,960,934 |

|

New Delhi, Delhi |

INR 293,614 – INR 822,120 |

|

Pune, Maharashtra |

INR 304,350 – INR 1,035,000 |

|

Bangalore, Karnataka |

INR 178,793 – INR 1,208,048 |

|

Hyderabad, Andhra Pradesh |

INR 400,000 – INR 1,280,000 |

Salary Of Company Secretary Based Degree or Certification

|

Certification or Degree |

Annual Average Salaries |

|

Bachelor of Commerce or B.Com |

INR 344,348 – INR 670,000 |

|

Bachelor’s Degree |

INR 183,831 – INR 1,174,457 |

Company Secretary Perks & Benefits

- Private Medical Insurance

- Paid Sick Leave

- Stock Options

- Life Insurance/ Disability

- Company Pension Plan

- Bonus

Differences in Nature of Work of CA and CS

Company Secretaries organize and prepare agendas to oversee policies, maintain statutory books, deal with correspondence, collate information, write reports, advise members on the legal, governance, accounting, and tax implications of proposed policies. They also take responsibility for the health and safety of employees and manage matters related to insurance and property.

On the other hand, Chartered calculate taxes; prepare tax returns, review account books, and accounting systems for efficiency and use of accepted accounting procedures. They evaluate financial operations and make best-practices advice to management, improve revenues, suggest ways to reduce costs, and enhance profits.

CAs also review the company’s systems and analyze risk; advise clients on tax planning, tax issues, business acquisitions, and mergers.

Differences in Workplaces of CA and CS

Company Secretaries have the option of joining corporate sectors as they assimilate and maintain corporate laws, governance, administration, board and shareholders meetings, etc.

If we keeping aside the option of the corporate sector, a company secretary can also go for independent practice as well.

Independent practitioners require a Certificate from ICSI to practice independently. They can be employed by small firms on retainers for professional advice and support on issues such as licenses, registrations, loans, taxes and partnership deeds.

Chartered Accountants have much more diversified options for selecting a workplace. These include government organizations, private organizations, business enterprises, the banking and insurance sector, law firms, civil services, etc.

Overall Comparative Table of CA vs CS

|

Section |

CA |

CS |

|

Certification Organized by |

Chartered Accountant (CA) is one of toughest exams to pass. It is being conducted by the Institute of Chartered Accountants of India (ICAI). |

CA is one of the hardest exams to pass. It is being conducted by the Institute of Chartered Accountants of India (ICAI). |

|

Number of levels |

To qualify as a Chartered Accountant, you need to qualify for 3 levels. First is the Competency Professional Test (CPT). Once you pass CPT, you are suitable to sit for Integrated Professional Competence (IPC). If you clear PCE, you will be able to give the Final exam. |

Even CS has three levels. First, you require to pass the Foundation course, then Intermediate and then you can eligible for the Final course. |

|

Mode/Duration of exam |

There are many subjects at each level of Chartered Accountancy. The duration is 3 hours for each exam at each level |

Each exam at each level has 2 papers and each paper is of 90 minutes duration. As a complete, each exam at each level takes about 4 hours with a break of 1 hour in between |

|

Subjects |

• The subjects for CA are as follows – |

• Let’s look at the subjects of CS – |

|

Pass % |

Unlike any other professional courses, CA is a very tough nut to crack. Only 5.75% of students could clear the exam in 2015 |

In 2015, the pass percentages of CS is also very less. In 2015, only 3.61% of students cleared all the modules. |

|

Fees |

For the CA course, the total fees are affordable. Any student who can study hard and have a knack for accounting can do all three levels of CA within the US $ 900 - $1000 including registration and examination. |

Even CS fees are also very reasonable. It’s around the US $500 |

|

Job opportunities/Job titles |

Job opportunities for CAs are massive. The top 5 job opportunities are in Accounting, Auditing, Taxation, Mgmt. Accounting and Consulting firms |

CSs can work as legal experts, corporate planner and strategic manager, chief advisor to the board of directors and as exe. Sec. to MD or CEO of any well-reputed company. |

|

Pro-tip |

If you can successfully complete your CA, you will have much respect and recognition in the society, and along with that you can choose many careers as each subject in the final module of the course is an industry. |

As CS you can responsible for corporate governance and the different company laws in the organization. After finished CS you will be treated as an expert in Company Laws and Practice. |

Conclusion

In a nutshell, Company Secretaries are in house legal experts who with their knowledge and wit, advise companies in decision-making. On the other hand, Chartered Accountants use commerce-related tools to maximize profits for a company. What they have in common though is hard work, dedication, and the right analytical aptitude.

If you can do both courses you will get the best results. But it’s not easy to pursue both of the courses simultaneously. If you would like to pursue even one of these, remember it’s a full-time job. Part-time work will not help you crack these exams. You need to study really hard. Go through the above details and pick what best suits you.

CA Exams are conducted in the month of May and November every year whereas CS exams are conducted in the month of June and December every year. A CA can apply for jobs as an auditor, accountant, management accountant, and so on whereas a CS can apply for jobs as a strategic manager, legal expert, chief advisor, corporate planner, and executive secretary. As compared to the CS course, CA course takes a longer time to complete. A CS Course is totally law-oriented whereas a CA course is more of accounts oriented. ICAI organizes the CA course whereas ICSI organizes CS courses.

Hope this write-up gave you a clear insight into both of the careers and makes your choice easier.

.jpg)